Proactive Protection: Bagley Risk Management Techniques

How Animals Threat Protection (LRP) Insurance Policy Can Protect Your Animals Financial Investment

In the world of livestock investments, mitigating risks is paramount to guaranteeing financial security and growth. Livestock Risk Protection (LRP) insurance policy stands as a reliable guard against the uncertain nature of the marketplace, using a calculated approach to safeguarding your assets. By delving into the intricacies of LRP insurance coverage and its multifaceted advantages, livestock manufacturers can strengthen their investments with a layer of safety that goes beyond market changes. As we check out the realm of LRP insurance coverage, its role in protecting livestock financial investments ends up being increasingly obvious, promising a course towards lasting financial durability in an unstable industry.

Recognizing Livestock Threat Defense (LRP) Insurance Coverage

Understanding Livestock Danger Defense (LRP) Insurance policy is vital for animals manufacturers seeking to alleviate financial dangers related to cost fluctuations. LRP is a government subsidized insurance item developed to safeguard producers versus a drop in market costs. By giving coverage for market price declines, LRP helps producers secure a flooring price for their animals, making sure a minimal level of revenue no matter of market changes.

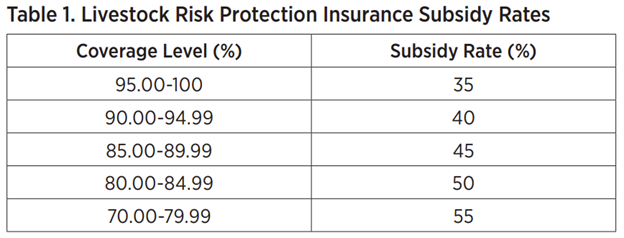

One secret facet of LRP is its adaptability, enabling producers to customize coverage levels and plan lengths to suit their specific requirements. Manufacturers can pick the variety of head, weight variety, insurance coverage cost, and insurance coverage period that line up with their production goals and risk tolerance. Recognizing these customizable options is crucial for producers to properly manage their cost danger exposure.

Additionally, LRP is offered for various livestock types, consisting of livestock, swine, and lamb, making it a versatile threat administration device for livestock producers throughout different fields. Bagley Risk Management. By acquainting themselves with the details of LRP, producers can make educated choices to guard their financial investments and make sure financial security when faced with market uncertainties

Advantages of LRP Insurance Policy for Animals Producers

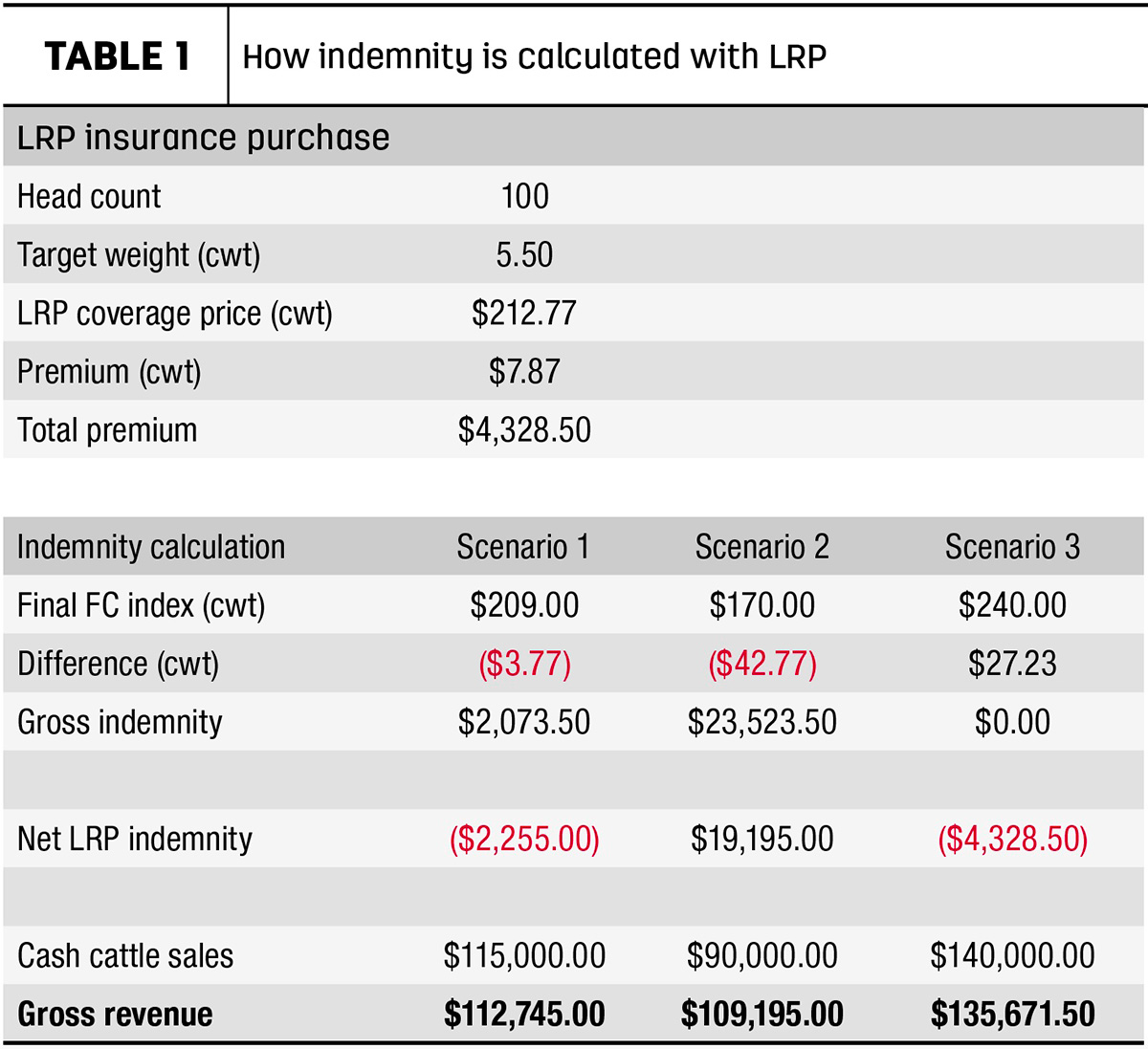

Animals manufacturers leveraging Livestock Threat Protection (LRP) Insurance policy gain a tactical advantage in securing their investments from price volatility and protecting a stable monetary ground amidst market unpredictabilities. By establishing a flooring on the price of their animals, producers can minimize the risk of substantial economic losses in the event of market declines.

Furthermore, LRP Insurance policy supplies producers with peace of mind. In general, the benefits of LRP Insurance for animals manufacturers are significant, offering a beneficial device for handling danger and ensuring monetary security in an unpredictable market environment.

Just How LRP Insurance Policy Mitigates Market Risks

Mitigating market dangers, Animals Risk Protection (LRP) Insurance gives livestock producers with a trusted guard against rate volatility and monetary uncertainties. By providing defense against unanticipated price decreases, LRP Insurance policy aids manufacturers protect their financial investments and preserve monetary security when faced with market variations. This kind of insurance policy enables animals producers to secure a rate for their pets at the start of the policy period, guaranteeing a minimum cost degree no matter market modifications.

Actions to Protect Your Animals Financial Investment With LRP

In the world of farming risk administration, applying Livestock Danger Protection (LRP) Insurance involves a calculated process to safeguard investments against market fluctuations and uncertainties. To safeguard your livestock financial investment efficiently with LRP, the very first step is to analyze the certain risks your procedure deals with, such as cost volatility or unforeseen weather condition occasions. Recognizing these dangers allows you to determine the protection degree required to secure your investment adequately. Next off, it is crucial to research study and pick Look At This a trustworthy insurance coverage supplier that offers LRP policies tailored to your livestock and service demands. When you have picked a service provider, thoroughly assess the policy terms, conditions, and insurance coverage restrictions to ensure they line up with your threat monitoring objectives. Furthermore, regularly keeping an look these up eye on market patterns and changing your protection as needed can help optimize your protection against potential losses. By adhering to these actions vigilantly, you can enhance the safety and security of your livestock financial investment and navigate market uncertainties with confidence.

Long-Term Financial Protection With LRP Insurance Policy

Making sure enduring financial security with the application of Livestock Threat Security (LRP) Insurance policy is a prudent long-lasting technique for agricultural producers. By integrating LRP Insurance policy into their danger management strategies, farmers can secure their livestock financial investments against unpredicted market variations and damaging events that could endanger their financial health with time.

One secret benefit of LRP Insurance policy for long-lasting economic security is the comfort it supplies. With a trustworthy insurance policy in area, farmers can mitigate the financial dangers associated with unstable market conditions and unexpected losses as a result of factors such as disease episodes or natural calamities - Bagley Risk Management. This stability permits producers to concentrate on the daily procedures of their livestock company without consistent bother with possible monetary troubles

In Addition, LRP Insurance policy gives an organized strategy to handling risk over the long-term. By establishing specific protection levels and picking ideal endorsement durations, farmers can customize their insurance policy intends to line up with their monetary objectives and take the chance of resistance, making certain a safe and secure and lasting future for their animals procedures. In final thought, buying LRP Insurance policy is a positive approach for agricultural manufacturers to attain enduring economic security and protect their source of incomes.

Conclusion

Finally, Animals Threat Security (LRP) Insurance coverage is a useful device for livestock manufacturers to mitigate market risks and secure their financial investments. By understanding the advantages of LRP insurance and taking steps to apply it, manufacturers can accomplish long-lasting economic protection for their procedures. LRP insurance coverage gives a safeguard against rate fluctuations and guarantees you could check here a degree of stability in an uncertain market setting. It is a sensible selection for securing livestock financial investments.